Simple Personal Budget Template For Mac

- Home Budget Template For Mac

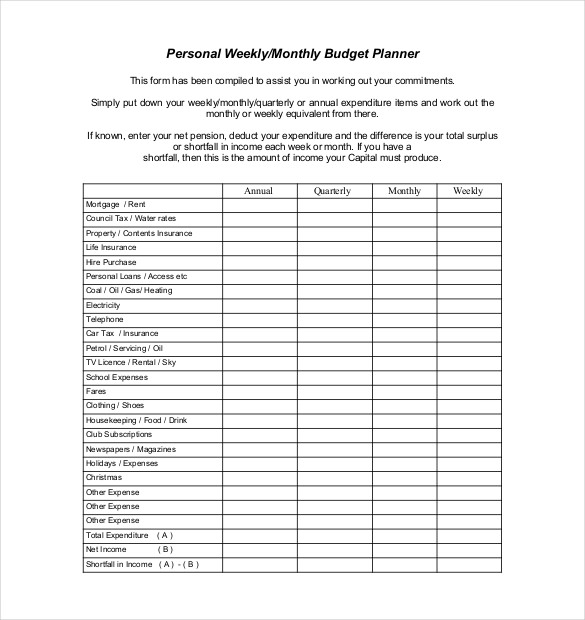

- Simple Budget Templates Free Printable

- Simple Personal Budget Template For Mac

One of the most popular and affordable ways to create a digital budget is with. When you create a budget template in MS Excel, you can fully customize your budget to track your monthly income and expenses. As the budget process can feel slightly overwhelming at first, this guide will help create your own Excel budget. There are two different ways to create an Excel budget template.

Home Budget Template For Mac

You can either get started with a template or build your own. You will learn how to do both. The Easy Way To Create an Excel Budget Template If you are pressed for time or don’t want to worry about the formulas, you can start to create a simple budgeting worksheet in five minutes. Step 1: Choose a Template There is a budget template for almost any category.

Whether you are a, are a, or need a business budget, there is most likely a template for you. You can get started by simply entering “Budget” into the search field. Or, use a more specific keyword like “college budget” or “monthly budget.”.

Simple Budget Templates Free Printable

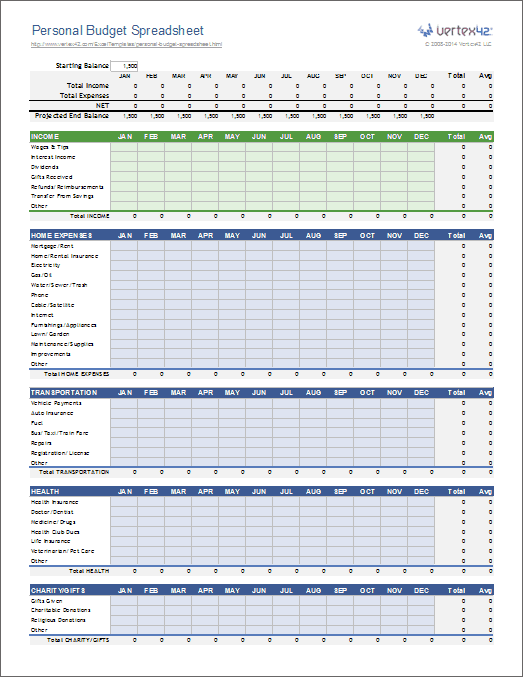

Choose a template that displays the information in a visually appealing manner There are over 100 different templates to choose from that range from a simple line-item budget to templates that will display your information with pie charts and bar graphs. These additional charting options can make it easy to see how your savings goals match with your spending if you like visual examples. If you cannot decide on a single template at first, open two or three different templates and test out the features. Try entering income, expenses, and adding additional budget categories to gauge your quality of interaction. In a matter of minutes, you should be able to determine which templates will be a better option. Step 2: Enter Income and Expense Information If you have previously tracked your expenses and income on a monthly basis, this task should be relatively quick.

All you need to do is transfer the information into the new Excel budget template. Most templates come with tabs that make it easy to enter the detailed information and automatically update the template’s summary tab. Clicking on the tabs on the bottom of the template make it easy to create your budget! Looking at the screenshot above, you will enter your monthly income, expenses, and savings into the respective tab. This particular template (Personal budget) makes it easy to enter the due date and amount for every bill.

You can also enter the days you get paid or put money into your savings accounts. If you need to add a budget category or an additional income stream, you can usually begin typing in a row or right-click a row number and click “Insert” to add a new row above. The DIY Way: Create an Excel Budget Template from Scratch The second way to create a budget template is to make your own with a blank Excel spreadsheet. Step 1: Create a New Workbook The first step is to create a new workbook when you open Microsoft Excel. Simply click “New Blank Workbook” when you first open Excel.

Beginning with the Column B, you can type in the name of each month. This allows you to track your expenses for an entire year on the same sheet.

For the more detailed oriented, you may want to create a weekly budget worksheet. Track your income and expenses by category and month Step 2: Enter Income and Expenses The next step is to enter your income streams and expenses. This can be as detailed or basic as you desire. If you are self-employed and want to track income by the client, each row can record how much you earned from each contractor. Expenses can be general categories like entertainment, housing, investing, or, you can break it down into mortgage, property taxes, homeowner’s insurance, etc.

The same thing goes for the other categories like cell phone and internet, or do those get combined in a basic living expenses category? Step 3: Add Formulas One advantage of using Excel instead of pencil and paper is that you can add Auto Sum formulas that automatically calculate how much you earn or spend.

Formulas take a few seconds to setup, but, can save a lot of headaches. Formulas take a few seconds to setup and can save you minutes in calculations To calculate how much you earn (or spend) each month follow these steps:. Click the box where you want the total of several boxes to appear (Cell B6 in this example).

Simple Personal Budget Template For Mac

Click the Auto Sum button in the top-right portion of the Screen. Drag the box to expand or reduce the number of cells to include in the auto sum. Or, manually enter the information by replacing the cell numbers in the function bar. Enter information into the appropriate cells and watch the AutoSum update your figures. Do this same exercise for all the other months for the income and expense fields. You can either click the AutoSum button for each month or copy and paste the formula into each new column and update the letters. Step 4: Compare Income to Expenses If you want to quickly see if you are spending less than you earn, you can also compare income to expenses with a formula.

You can place this box wherever you wish. For the purposes of this example, it is located beneath the expenses in cell B20. Quickly see how much you saved vs. Spent with this formula The formula is really simple: =SUM(B6-B18) Update the cell numbers to correspond with your spreadsheet to subtract the expenses from your income. Step 5: Save Your Spreadsheet Once you have entered all the formulas, it is time to save your budget template. You can name it 2018 Budget, Monthly Budget, etc. Saving a blank copy makes it easy to create duplicate budgets for future budget years or to send to a family member or friend that needs a budget template.

Or, you can always add additional tabs to easily track your spending year-over-year in the same workbook. Summary Microsoft Excel is a great alternative to traditional. By creating your own budget template or entering your own information, you can quickly track your income and spending on a daily, weekly, or monthly basis all in one place. You can keep your template as basic or detailed as you desire.

Don’t have Microsoft Excel? Check out some.

Also you can check out it’s a service that automatically consolidates your daily financial transactions into Google Sheets You can also to help create a budget too. Check out our review on one of the easiest ways to track your spending.

Disclosure: The information provided by The Financial Genie is for informational purposes only. It should not be considered legal or financial advice. You should consult with an attorney or other professional to determine what may be best for your individual needs. The Financial Genie does not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. Additionally, some of the organizations with products on our site may pay us a referral fee or affiliate commission when you click to apply for those products.

©Bright Hub Inc. When you’re playing the role of project manager for a personal project like or a family vacation, you’ll need a budget to predict and manage your costs. You can use a Project Budget Template from Vertex42 to keep track of expenses like labor, materials, fixed costs and your actual spend — at every step of the project. Breaking things down this way can help you better monitor your spending over time, so you don’t end up being out of money before the project is complete. Download this Up Next: No matter whether you prefer a weekly or monthly budget, or an Excel or a Google Docs template, the important thing about budgeting is to start now. Getting a handle on where your money goes as soon as possible will give you the information you need to make any necessary changes. Then, you’ll be better able to achieve your short- and long-term financial goals.